Brand Distinctiveness and Salience: Measuring What Makes Your Brand Stand Out

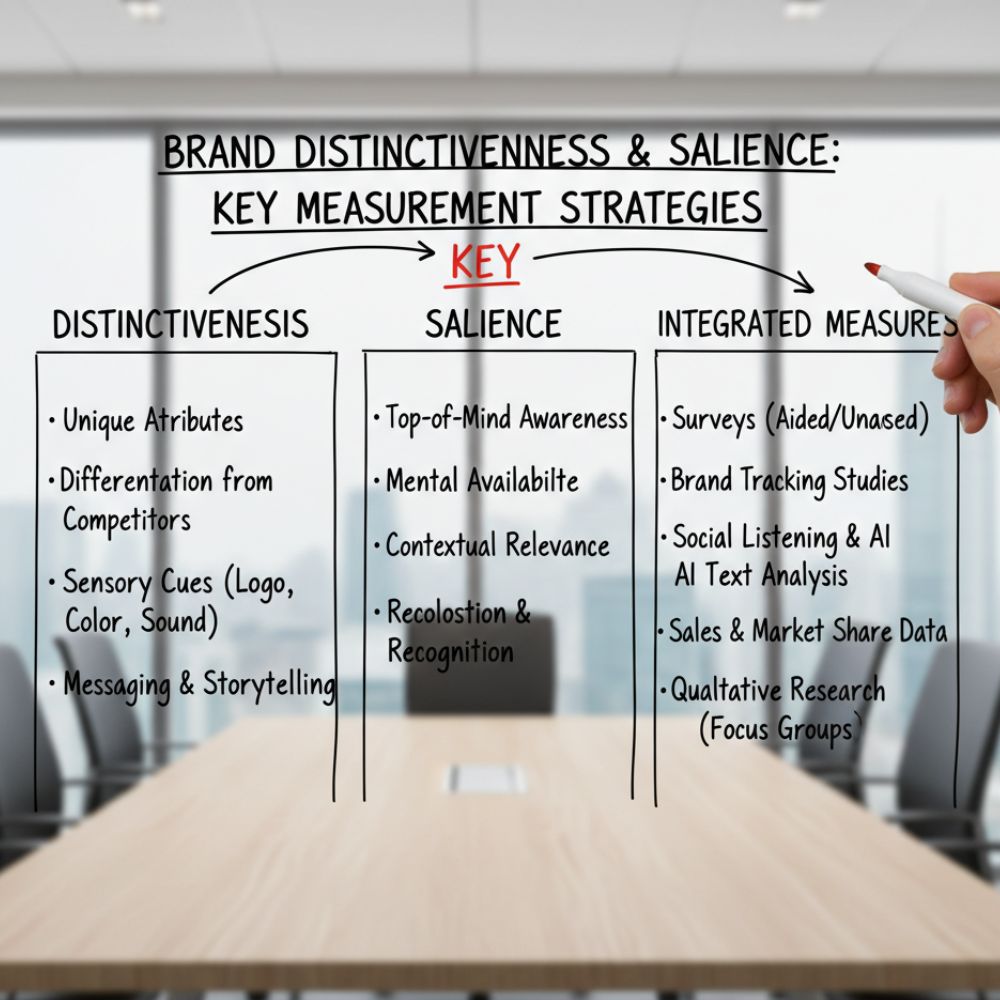

The modern branding landscape has evolved far beyond simple awareness metrics. Today’s top-performing brands understand that brand distinctiveness—how uniquely a brand stands out—and brand salience—how easily it comes to mind—are distinct yet equally crucial dimensions of brand performance. Properly measuring both allows companies to gain actionable insights that improve brand strategy, customer engagement, and market impact.

Many organizations mistakenly treat distinctiveness and salience as interchangeable, leading to misaligned strategies and missed opportunities. By measuring each dimension carefully, brands can make smarter investments and optimize marketing outcomes.

Defining Brand Distinctiveness and Salience

Brand distinctiveness represents how uniquely identifiable your brand is within its competitive context. It includes visual, verbal, and experiential elements that signal “this is us” to consumers. Distinctive brands are immediately recognizable through ownable assets that competitors cannot replicate.

In contrast, brand salience measures how readily your brand comes to mind in relevant purchase or usage situations. A salient brand is mentally available when category needs arise, making it the instinctive choice for consumers. While distinctiveness focuses on standing out, salience ensures the brand shows up at the right moment. Both are essential for effective brand performance.

Measuring Brand Distinctiveness

Effective measurement starts with distinctive asset research, identifying which brand elements consumers uniquely associate with your organization. This includes colors, logos, slogans, sounds, and other brand identifiers. Metrics such as fame scores and misattribution testing highlight how well your assets stand out from competitors.

Distinctiveness decay measurement tracks how quickly brand recognition deteriorates without reinforcement, helping marketers optimize refresh schedules for visual identity, messaging themes, and experiential elements. Leading brands like Coca-Cola, Apple, and Nike use these frameworks to monitor their distinctive assets across touchpoints and campaigns.

Measuring Brand Salience

Category entry point mapping forms the foundation of salience measurement, identifying the triggers and situations that prompt consumer consideration. Techniques like share of mind studies, response latency testing, and mental network mapping reveal how quickly and strongly your brand comes to mind relative to competitors.

Advanced approaches capture millisecond-level differences in brand recall, which often predict market share changes before they appear in sales data. Measuring salience across different usage occasions, need states, and contexts ensures your brand maintains mental availability and maximizes purchase likelihood.

Integrating Distinctiveness and Salience

While distinctiveness and salience are separate constructs, their combination creates powerful competitive effects. Integration metrics like distinctive salience scoring and retrieval disruption testing reveal whether your brand is both uniquely recognizable and highly available in consumer memory.

Memory structure mapping identifies how central your brand is in mental networks for a category. Brands that achieve both high distinctiveness and salience dominate consumer choice and enjoy long-term competitive advantage.

Practical Applications and Insights

Measurement systems become most valuable when they directly inform brand strategy. By correlating distinctiveness and salience scores with purchase behavior, customer loyalty, and ROI, brands can identify which assets and campaigns drive the most impact.

Regional variations, digital touchpoints, and generational differences must also be considered. Metrics should track performance across geographies and consumer segments to ensure consistent brand performance while adapting to local market dynamics.

Emerging techniques, such as implicit association testing, eye-tracking studies, and behavioral analytics, reveal unconscious perceptions of your brand, complementing traditional research methods. Longitudinal tracking of cohorts shows how distinctiveness and salience evolve over time, distinguishing between temporary perception changes and enduring brand strength.

Future of Brand Measurement

As attention fragments across digital and physical touchpoints, brands are developing cross-context salience metrics to track mental availability in varied environments. Artificial intelligence now enables automated recognition of distinctive visual, verbal, and experiential patterns, helping marketers identify new opportunities faster than traditional methods.

Real-time measurement through mobile and digital platforms provides insights in authentic usage situations, complementing retrospective studies and giving brands actionable data on mental availability, recognition speed, and recall strength.

Conclusion

Mastering brand distinctiveness and salience gives companies a competitive edge. Distinctiveness ensures your brand stands out, while salience ensures it is mentally available at the right moment. By developing measurement systems that capture both dimensions, integrating insights into strategy, and leveraging modern tools like AI and behavioral analytics, organizations can make smarter brand-building decisions.

Brands that excel in these areas, such as Coca-Cola, Apple, Nike, and National Geographic, achieve lasting market impact, consumer preference, and brand loyalty. Understanding and measuring these two dimensions is not just a research exercise—it is a critical step toward sustained success in an increasingly competitive marketplace.